New income limits for the Commonwealth Seniors Health Card

Pending the passage of legislation, the income limits for the Commonwealth Seniors Health Card are set to increase.

Read more

ACT NOW Super Contributions for YE 30 June 2022

Employers intending to claim a tax deduction in 2021/22 for employees’ June 2022 quarter super contributions should make payment ASAP to allow time for contributions to be processed through the superannuation clearing house and allocated to employee super accounts.

Read more

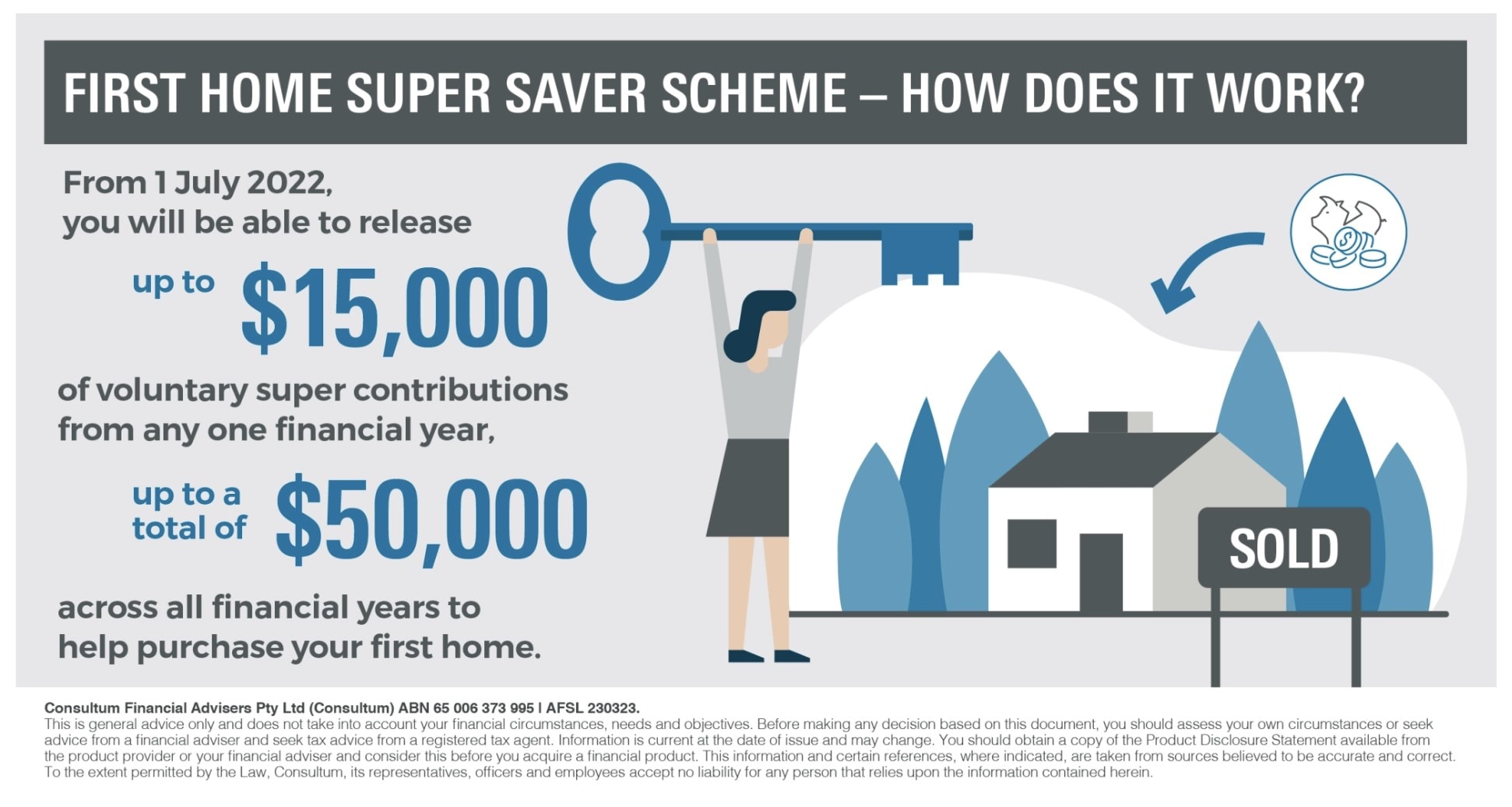

First Home Super Saver scheme – how does it work?

From 1 July 2022, if you’re a first home buyer you can release up to $50,000 from your voluntary super contributions to help you buy your first home.

Read more

Super to cover more employees

From 1 July 2022 the $450 per month threshold for SG eligibility will be removed. The change will expand the coverage of SG to eligible employees regardless of their monthly pay.

Read more

Changes to work test requirements for non-concessional contributions

From 1 July 2022 members under 75 years of age will no longer have to meet the work test to make non-concessional contributions.

Read more

Super changes from 1 July 2022

Superannuation changes by the Government were proposed in March's Federal Budget and come into effect from 1 July this year.

Read more

Increase in SMSF Membership

From 1 July 2021, self-managed super funds (SMSF) and small APRA funds (SAFs) will be able to have up to six members. It is important to seek professional advice and check State or Territory law restrictions before registering or expanding your fund.

Read more

2021/22 Pension Payments

If you are receiving a pension from your SMSF your minimum annual pension payment for 2021/22 will be re-calculated upon finalisation of the 2020/21 financial accounts and you will be notified of the relevant amount to withdraw before 30 June 2022. A temporary reduction of 50% of the minimum pension drawdown applies for the 2021/22 financial year due to the Covid-19 pandemic.

Read more

2021/22 Contribution Limits

Concessional contributions are before-tax contributions that include both employer contributions and personal contributions for which a person may be eligible to claim a tax deduction in their personal income tax return. The concessional contribution limit is $27,500 for 2021/22.

Read more